When the Yeezys first came out in 2016, I was one of the folks that lined up outside the store to acquire a pair. It was a terrific side income for me at the time because each pair could easily be “flipped” – resale for 2x–3x its retail price. Personally, I am a fan of sneakers since a great pair of shoes can be worn with any outfit you choose.

Hence, what footwear brands come to mind right now?

Nike and Adidas are the two footwear companies that come to mind. Since forever, these two renowned global firms from two separate continents – the United States and Europe have been hot favorites in the sectors of footwear and sportswear. Although these two firms appear to have identical business plans, there are significant variations between them.

Nike is today’s world’s most valuable apparel brand, with a market capitalization of $189 billion (as of 10th June 2022). Nike does have its fair share of criticisms – labor conditions, environmental impact, and animal welfare. With the recent tech sell-off, Nike dropped over 40%, could this be a potential opportunity to buy Nike stock?

An Overview of Nike’s Business

1. Key Product & Services under Nike

2. Operating Model

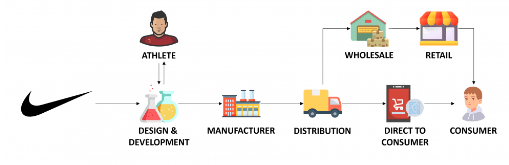

Nike works very closely with world-renowned athletes such as Michael Jordan, LeBron James, Tiger Woods, Cristiano Ronaldo, and Rafael Nadal, just to name a few. Thus, Nike managed to develop state-of-the-art technologies to enhance the comfort and performance of their sportswear.

Nike has built its global presence around the world with 325 U.S. retail stores – 204 Nike Factory Stores, 30 NIKE Brand in-line stores (including employee-only stores) and 91 Converse stores (including factory stores) and 723 Non-U.S. retail stores in the international market – 618 NIKE Brand factory stores, 46 NIKE Brand in-line stores (including employee-only stores) and 59 Converse stores (including factory stores). Hence, the total number of Nike retail stores around the world is 1,048.

Qualitative Factors affecting Nike

Let’s now take a deeper look into the qualitative aspects that affect the business.

Nike’s Economic Moat

1. Brand Equity

In 2022, Nike retains the title as the world’s most valuable apparel brand while luxury brands boom after COVID-19. With COVID expediting the process of consumers’ expectations of the apparel industry, we saw the aggregate brand value of luxury apparel brands grow 21% this year (from US$103 billion to US$125 billion), sportswear brands grew 10% this year (from US$68 billion to US$74 billion), and fast fashion brands dropped 7% (from US$44 billion to US$41 billion). After being crowned the most valuable apparel brand in 2022, Nike has an aggregate brand value of over $33.2 billion, according to Brand Finance.

2. Economies of Scale

As the world’s largest footwear and apparel manufacturing company, Nike managed to achieve significant economies of scale in manufacturing, distribution, and sales processes that led to healthy margins. Nike also managed to build long-term relationships with their contract manufacturing suppliers. 90% of these suppliers have worked with Nike for over 15 years. Nike has diversified its geographic operations and is sold in more than 170 countries. Hence, as Nike begins to grow and open new factories, this allows Nike to lower and lower average total costs as it grows.

Growth Opportunities for Nike

1. Margin Expansion

| Margin Expansion | 2017 | 2018 | 2019 | 2020 | 2021 |

| EBIT Margin % | 13.8% | 12.2% | 12.2% | 8.3% | 16.2% |

Nike has valuable digital assets, such as the Nike mobile app, the SNKRS app, NTC (Nike Training Center) and NRC (Nike Run Club), which have helped in Nike’s marketing. An instance was when Nike collaborated with EA Sports to give members who ran 5 miles in the Nike Run Club the opportunity to unlock rewards in the Madden NFL game.

Nike’s EBIT margin has dramatically increased in 2021. In 2018, margins were compressed due to a result of product mix and location of sales. In 2020, COVID hit Nike and margins were severely compressed. While in 2021, Nike’s investments in digital have been paying off relatively well. In FY 3Q22, digital revenue was up 22% and the Nike mobile app grew more than 50% to surpass nike.com. Hence, the focus on Nike’s digital assets has helped in Nike’s margin expansion.

2. Jordan Brand

The Jordan Brand has been a huge success factor for Nike since signing Michael Jordan back in 1984. Compared to 2020, the revenue brand of Jordan Brand increased by 31% in 2021, and it was also the highest growth product category among all other categories. Over the years, the Jordan Brand has evolved into a lifestyle brand that has attracted a cult-like following. Consumers are willing to wait hours outside retail stores just to get their hands on a pair of these sneakers. An identified buyer paid US$615,000 for the red, black, and white Nike Air Jordan 1 sneakers that were worn during a 1985 exhibition game in Trieste, Italy. Hence, the Jordan brand looks poised to seek growth in the foreseeable future. While, this my friend, is the power of branding!

Business Risks for Nike

1. Supply Chain Issues and Raw Materials Price Increase

Supply chain issues have been prevalent around the world ever since COVID. With heated tensions in Ukraine and Russia, these supply chain issues have intensified. Previously, all footwear factories in Vietnam were closed due to government mandates relating to COVID-related issues, which resulted in a ten-week slow down in production.

There were severe price increases as interest rates and inflation continued to steadily increase amid efforts to stop hyperinflation. Prices in transportation, logistics, and air freight increased as well. Thus, Nike has to increase its prices in order to offset the above factors. However, if prices continue to increase, consumers might cut back on spending, which could cause severe repercussions for Nike’s revenue.

2. China’s Zero-Covid strategy

China requires cities to enter strict lockdowns (Zero-Covid Strategy) even if just a handful of cases are reported. Initially, China was seen as an example of a country handling the virus relatively successfully at the start of the pandemic. Amid the lockdown, many big corporations are heavily affected. You are right, Nike is one of them. In 3Q 2022, Greater China revenue decreased 11% year-over-year. While its EBIT decreased 20% year-over-year. Hence, if China’s Zero-Covid strategy persists, there could be a much more severe impact on the top and bottom line of Nike’s financials.

Quantitative Factors affecting Nike

Let’s now take a deeper look into the quantitative aspects of the business.

1. Financial Highlights (Revenue Breakdown)

The majority of Nike’s revenue in 2021 and LTM still predominantly comes from Nike Brand, at 95% consistently over the last 3 years. The Nike brand is further broken down into footwear, apparel, equipment, and its global brand division. Nike’s Converse Brand has remained steady at around 5% of its revenue. While Corporate has finally started earning money on its top line this year, making $40 million this year. However, it contributed to less than 1% of Nike’s revenues.

In 2021, North America accounted for over 40.6% of its revenue. While Europe, Middle East & Africa (EMEA) amounted to 27.1%, 19.6% in Greater China, 12.6% in Asia Pacific & Latin America (APLA) and 0.1% for its Global Brand Divisions.

2. Key Valuation Ratios

When evaluating the financial state of a growing firm like Nike, we must assess key financial ratios such as Revenue Growth, P/S, P/E, Gross Margin%, Operating Margin%, and FCF.

Revenue Growth (5 Years)

Nike’s FY2021 revenue is at USD$44.54B with 19.1% (YoY growth) and its 5-Year CAGR stands at 5.33%.

Price/Earnings (P/E) ratio (1 Year)

The current Nike P/E stands at 30.27x while it’s 1-year Avg P/E ratio stands at 40.73x

Price/Earnings (P/E) ratio (5 Year)

The current Nike P/E stands at 30.27x while it’s 5-year Avg P/E ratio stands at 46.89x

Price/Sales (P/S) ratio (1 Year)

The current Nike P/S stands at 3.87x while it’s 1-year Avg P/S ratio stands at 5.14x

Price/Sales (P/S) ratio (5 Year)

The current Nike P/S stands at 3.87x while it’s 5-year Avg P/S ratio stands at 4.04x

Other Key Ratios

A company’s profitability is measured using two metrics: gross profit margin and operating profit margin. The difference is that gross profit margin only considers direct manufacturing costs, but operating profit margin also considers running expenses such as overhead. Free Cash Flow (FCF) represents the cash available for the company to repay creditors and pay out dividends and interest to investors.

Looking at Nike’s financials, its gross margin has remained relatively stable at around 44%. Its operating margin has also increased steadily from 11% in 2017 to 15% in 2021. Its free cash flow margin has also increased steadily to 13.4% in 2021. The primary drivers of margin growth behind Nike’s margin increase appear to be:

- Nike focuses on its digital assets pay off as margins expand

- Consumers are more willing to pay full price for merchandise, which helps Nike’s margins.

| Other Key Ratios | 2017 | 2018 | 2019 | 2020 | 2021 |

| Gross Margin % | 44.6% | 43.8% | 44.7% | 43.4% | 44.9% |

| Operating Margin % | 11.2% | 13.6% | 15.1% | 6.6% | 14.9% |

| FCF% | 8.0% | 10.8% | 12.2% | 3.7% | 13.4% |

Our Stand

Nike is one of the most recognized brands in the world. It is also the undisputed leader in the sporting goods industry. Nike is a marketing icon, some would say the best in the world. Nike’s classic tagline, “Just do it” along with famous athlete endorsements and the swoosh logo, have become more popular among consumers than ever. Over a period of decades, investors have been so impressed with steady operating gains that they are now considered something of a blue-chip no-brainer to own in portfolios. However, to me, such blind investor optimism could be setting up the stock for a huge, multi-year decline as revenue is only growing at a mid-single digit growth year-over-year.

Although Nike stock has come down substantially from its highs, the outlook for Nike still remains questionably in doubt. There are many macro concerns that the company might have to deal with in the short term, but they may be outside of Nike’s control. First, there are increasing raw material prices. Next, supply chain issues and rising geo-political tensions could have a substantial impact on Nike earnings. Nike’s management also has a track record of committing to returning value to its shareholders, both in the form of dividend payments and share buybacks. As the valuation comes back to earth, investors have several options to capitalize on Nike’s success. Meanwhile, investing in Nike could be a potential solid dividend play as dividend payouts are very consistent. However, investing in US equities for dividends may not be the wisest play as we are subjected to a 30% withholding tax on all dividends for non-US persons. Hence, we are better off investing in SG-REITs or SG-banks’ equities.

You can check out our latest articles here: Ascendas REIT Stock Analysis and Apple Stock Analysis

Disclaimer: The information provided by LearnToInvest serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any stock.