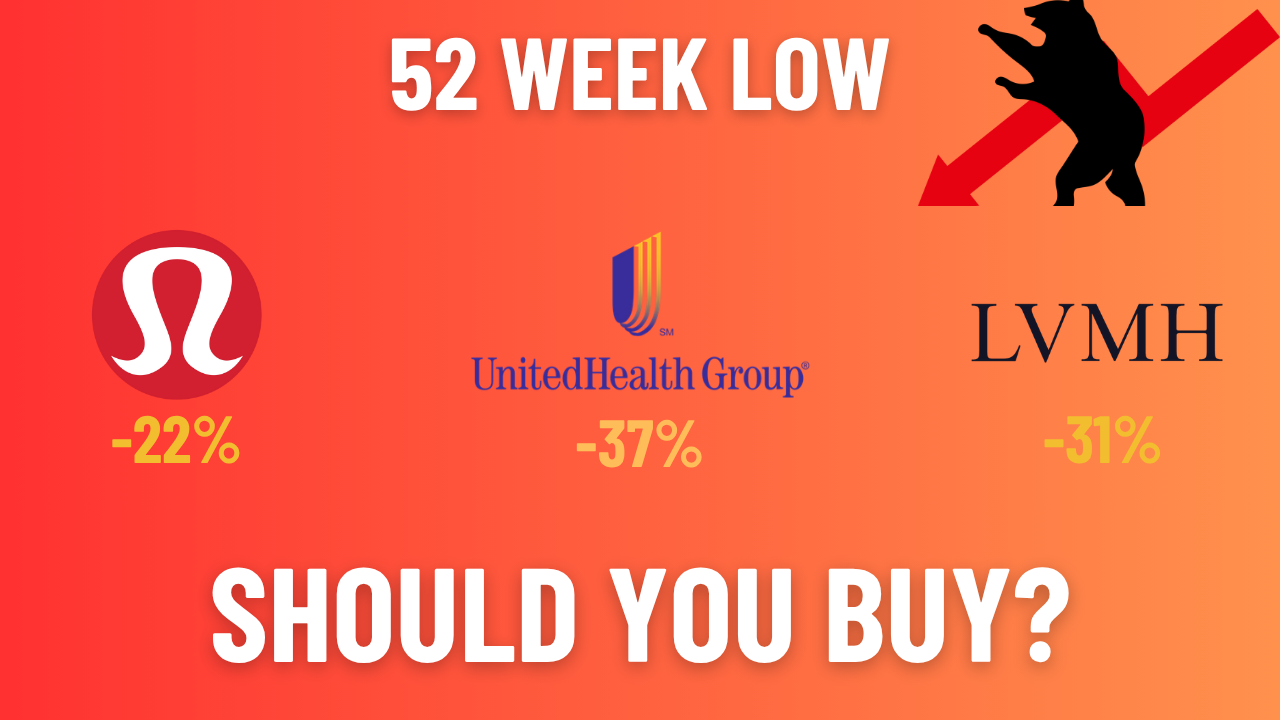

The S&P 500 and Nasdaq-100 (QQQ) continue to hover near record highs, powered by AI and tech momentum. But beyond the AI buzz, some top-tier companies have quietly fallen to their 52-week lows, offering rare entry points. If you have $3,000 to invest right now, this could be the perfect moment to pick up strong long-term plays that are temporarily out of favour. From healthcare and luxury to global athleisure, here are the top 3 stocks to buy now featuring Lululemon, UnitedHealth Group, and LVMH.

1. Top stocks to buy: LuLulemon Athletica (NASDAQ: LULU) – Premium Brand at a discount

Company Overview:

Lululemon is a global leader in premium activewear. It blends performance apparel with lifestyle fashion. The brand now includes men’s wear, accessories, and global expansion. Its direct-to-consumer (DTC) model brings strong margins and deep customer loyalty among the athleisure communities.

Recent Pullback:

The stock fell due to tariff concerns and slowing sales growth. Q1 revenue was $2.37 billion, with $314.6 million in profit. These are still strong numbers, considering market conditions. However, tariff risks may raise product prices and hurt demand. Some analysts adjusted their guidance, which rattled investors.

To consider:

Despite short-term concerns, the brand remains strong. International growth is a major strength. Mainland China revenue rose by 21.1%. At this valuation, Lululemon looks attractive. If you believe in the brand’s long-term potential, now is definitely a compelling entry point.

2. Top stocks to buy: LVMH Moet Hennessy Louis Vuitton (OTCMKTS: LVMUY) – Luxury Global leader with Resilient Demand

Company Overview:

LVMH is the world’s biggest luxury group. This brand shouldn’t be foreign to most ladies. It owns top-tier brands like Louis Vuitton, Dior, and Tiffany. The business spans fashion, watches, jewellery, cosmetics, and spirits. LVMH targets affluent consumers worldwide with its diversified and resilient luxury portfolio.

Recent Pullback:

Shares have slid in recent months due to a deceleration in high-end spending, particularly in China, coupled with macroeconomic headwinds across Europe. These factors have softened sales growth, raising concerns about the pace of luxury consumption recovery. In the recent Q1 revenue, LVMH published revenue of 20.3 billion euros which was a 3% decline from the past year. Furthermore, investor sentiment has also been dampened by broader market rotation out of European equities.

To consider:

LVMH maintains brand dominance and operational excellence. As global travel rebounds, especially in Asia, luxury demand should recover. Its strong balance sheet and pricing power make this a high-quality, long-term investment.

3. Top stocks to buy: UnitedHealth Group (NYSE: UNH) – A Defensive Giant in Healthcare

Company Overview:

UNH is the largest health insurance company in the United States. They offer medical plans for individuals, employers, and Medicare participants. Its Optum division provides high-margin healthcare services, analytics, and pharmacy solutions. This makes it a vertically integrated healthcare leader.

Recent Pullback:

UNH shares are down due to multiple negative developments within the company. Higher-than-expected medical costs, particularly in the Medicare Advantage segment, have squeezed UnitedHealth’s margins. Furthermore, they are also facing a criminal investigation from the DOJ for potential criminal medicare fraud. With all this negative news, their CEO Andrew Witty also announced his unexpected departure. As a result, UnitedHealth decided to withdraw its full year 2025 financial guidance, citing continued uncertainty and increased care activity. Though the company’s earnings remain steady over its recent earnings, sentiment has been shaken.

To consider:

At ~17x forward earnings, UNH trades below its historical average. This setup presents a buying opportunity for a recession-resistant and exposure to long-term healthcare demand. Once regulatory uncertainty settles, UNH’s stable fundamentals should attract defensive investors again.

Final Thought: Build a Strong Portfolio With $3000

While markets remain elevated in certain sectors, pockets of value exist in to -quality names with temporary headwinds. With $3,000, splitting your investment between Lululemon, UNH, and LVMH gives you a balanced portfolio. This will allow you to have exposure across premium consumer goods, defensive healthcare, and global luxury which are poised for long-term upside.

How you can support us

In addition, do check out our other latest articles. If you are keen, check out our articles on other analysis: Coinbase Joins the S&P 500: What does this means for Crypto and Circle (NYSE: CRCL) – The Hottest IPO explained simply

Or Signup for a Longbridge account now to get started in your investing journey.